Why Doubling Down Beats Diversifying

How staying focused on your core expertise creates unexpected leverage in partnerships and pricing

The Feature Trap

Every early-stage SaaS company faces this moment: customers start asking for features that successful competitors offer. The pressure intensifies when prospects say things like "we love your core product, but can you also do X like [competitor] does?"

The temptation is obvious and feels rational. Build more features. Check more boxes. Compete on breadth rather than depth. But for young companies still validating product-market fit, this diversification strategy often becomes a resource-draining trap that weakens positioning just when clarity matters most.

I recently worked with a Boulder-based SaaS analytics company wrestling with exactly this dilemma. They had genuinely superior quantitative analytics technology but kept getting pulled toward building competing workflow features. Every customer conversation seemed to lead to requests for board reporting tools, budget planning modules, or presentation automation.

"Everyone's asking for these features," the founder told me. "Should we build them to stay competitive?"

The Counterintuitive Answer

Instead of expanding into adjacent features, we explored a different question: How can you set the pace in your area of expertise while creating leverage through partnerships and pricing strategies?

The approach we developed ran counter to conventional competitive wisdom. Rather than chase feature parity with established players, we positioned their deep analytics capabilities as the intelligence layer that powers existing platforms. Think becoming the quantitative engine behind board reporting tools rather than building competing board reporting tools.

This shift required discipline. It meant saying no to feature requests that seemed logical. It meant resisting the urge to become a "complete solution" in favor of becoming an indispensable component of other solutions.

The Strategic Framework

Immediate Benefit: Crystal-Clear Value Proposition

The first advantage of staying focused emerged quickly: a crystal-clear unique selling proposition that could be validated and tested within a defined addressable market. No confusion about what they did best or who needed it most.

When you try to be everything to everyone, your messaging becomes muddled. Prospects struggle to understand your differentiation. Sales conversations lose focus. But when you own one thing completely, your value proposition becomes razor-sharp.

This clarity accelerated their validation process. Instead of testing multiple features across different use cases, they could focus on proving that their core analytics capability solved a specific problem better than anyone else. The feedback loops tightened, and product development became more targeted.

Downstream Impact 1: Pricing Power Through Differentiation

Staying focused on their core strength preserved pricing leverage in ways that feature expansion would have undermined. When you're not competing on feature checklists, you maintain the ability to charge for unique value.

This manifested in several ways:

Value-based pricing options: Because their analytics capabilities were genuinely differentiated, they could price based on the insights delivered rather than competing on per-seat or usage metrics that commoditize quickly.

Multiple pricing models: Strong differentiation enabled pricing flexibility. They could offer usage-based APIs for platform partners, subscription models for direct users, or project-based pricing for custom implementations—all while maintaining margins because the core value was hard to replicate.

Reduced price pressure: When you're the only option that delivers specific capabilities, competitive pricing pressure decreases. Customers compare value, not features.

The alternative—building competing workflow features—would have led them into direct price competition with well-funded competitors who had years of development head start and deeper feature sets.

Downstream Impact 2: Partnership Distribution Strategy

Perhaps the most significant advantage emerged in partnership opportunities. By positioning themselves as the intelligence layer rather than a competing platform, they became attractive to established players looking to enhance their offerings.

This created several strategic advantages:

Accelerated market access: Instead of expensive direct sales to acquire individual customers, they could reach entire customer bases through partnership channels. A single integration with an established platform could expose them to thousands of potential users.

Enhanced value propositions for partners: Existing platforms gained differentiated analytics capabilities without internal development costs. The partnership made both companies more competitive.

Superior margin structure: Distribution through partners often provides better economics than direct sales. Lower customer acquisition costs, shared marketing expenses, and reduced support burden while maintaining premium pricing for the core technology.

Market validation at scale: Partnership channels provided rapid feedback about product-market fit across diverse use cases without the time and expense of building direct sales operations.

The Competitive Moat

This focused approach created defensive advantages that feature expansion couldn't match. When you do one thing exceptionally well, you become harder to replace. Partners invest in integrations. Customers build workflows around your capabilities. Switching costs increase naturally.

The company became what I call an "embedded differentiator"—a component that makes other platforms more valuable while remaining difficult to replicate or replace. This position provides more sustainable competitive advantages than trying to out-feature established competitors.

Common Objections and How to Address Them

"But customers are asking for these features"

Customer feature requests often reflect workflow needs rather than core value requirements. The question isn't whether customers want additional features, but whether building those features is the best way to serve their underlying needs. Sometimes the answer is partnerships, integrations, or API connections that let customers use your core strength alongside other tools they already prefer.

"We need to be a complete solution"

Complete solutions are often inferior solutions. The platforms that win long-term typically excel at core capabilities while integrating well with specialized tools. Being complete is less important than being indispensable.

"Competitors are adding our features"

Let them. If you stay focused on advancing your core capability, competitors will always be playing catch-up in your area of strength while you can leverage their strengths through partnerships. The goal isn't to prevent competition but to make your core value so superior that competitive features become commoditized add-ons rather than differentiated capabilities.

Implementation Guidelines

1. Define Your Core Differentiator

Identify the one thing your product does better than any alternative. This should be specific enough to measure and defend, broad enough to build a business around. For the analytics company, it wasn't "analytics" generally but "cohort-level SaaS metrics with retention-adjusted unit economics."

2. Map Adjacent Markets

Identify where your core strength creates disproportionate value without requiring you to build competing workflows. Look for platforms or services that would be significantly enhanced by your capability but aren't direct competitors.

3. Design Partnership-First GTM

Structure your product and pricing to work well as an embedded component. This often means API-first development, white-label options, and pricing models that align with partner economics rather than just direct sales.

4. Resist Feature Creep

Establish clear criteria for feature development. Ask: Does this enhance our core differentiator or dilute it? Does this make our unique value more defensible or more replicable?

5. Measure Focus, Not Just Growth

Track metrics that reflect strategic discipline alongside growth metrics. How much development effort goes to core capabilities versus adjacent features? How defensible are your core advantages becoming over time?

The Broader Strategic Lesson

The temptation to expand beyond your expertise versus the discipline to double down represents one of the most critical strategic decisions for early-stage companies. The pressure feels urgent because customer requests seem to point toward obvious expansion opportunities. But expansion without focus often leads to mediocrity across multiple areas rather than excellence in any area.

Sometimes the smartest growth strategy is getting really good at one thing instead of getting mediocre at many things. This requires saying no to opportunities that seem logical, resisting customer feature requests that pull you away from your core strength, and finding creative ways to serve broader needs through partnerships rather than internal development.

The companies that master this discipline create sustainable competitive advantages while building partnership ecosystems that accelerate growth and preserve margins. Those that don't often find themselves competing on feature checklists in commoditized markets.

The choice between focused excellence and broad mediocrity shapes every other strategic decision a company makes. Choose focus. Double down on what makes you unique. Find partners who complement your strengths rather than trying to replicate theirs.

The market rewards depth more than breadth, especially for companies still proving their core value proposition.

About This Analysis

This strategic framework emerged from consulting work with early-stage SaaS companies navigating competitive positioning and partnership strategy. The principles apply across industries but are particularly relevant for technology companies where feature development decisions can either strengthen or dilute competitive positioning.

James Kroeker specializes in strategic partnerships and pricing strategy for growth-stage SaaS companies. He helps companies identify sustainable competitive advantages through focused differentiation and partnership-driven growth strategies.

When Pricing Follows

What Happens When SaaS Pricing Follows, Instead of Leads

In a recent role, we priced our SaaS product with a flat annual enterprise fee, loosely based on customer profiles. It seemed strategic, simple, scalable, and benchmarked against a familiar competitor on paper. In reality, it worked for no one. For context, we were approaching the EMEA market where we had little to no existing clients, and unlike a GTM motion in the US, not all regions can be treated the same. There are differences in pricing sensitivities, willingness to pay, and expectation of performance of Saas tools for financial services. These differences were most prevalent in the smaller to mid tier customers.

Too Big or Too Small Never Just Right

Our pricing structure was too large for smaller players, yet not complex or flexible enough for larger ones. It encouraged client usage, but with no pricing variable tied to outcomes or scale. There was no mutual growth, no incentive alignment, or opportunity for expansion. Just a one-size-fits-all model. The product's basic components were the same for all enterprises, the only difference being that large customers would collect and report on larger data sets, generally requiring more complex functions to generate and segment their Internal Rate of Return.

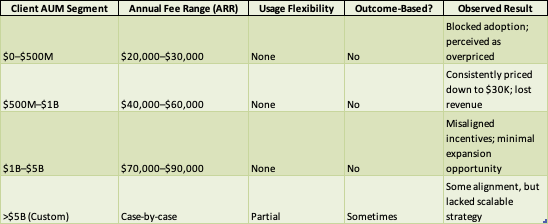

This “one-size-fits-none” approach looked clean on paper, but didn’t reflect the range of client needs or the value we were delivering. Here’s how our flat-fee ARR model played out across AUM segments:

Flat-Fee ARR Pricing Table

We anchored our pricing to a legacy competitor, not because it fit our product, but because it was familiar. The irony? We were trying to replace that legacy, while pricing like it.. But the irony was hard to ignore: we were trying to replace this legacy provider while mimicking their pricing. Our product was differentiated, but our pricing didn’t reflect that. It lacked originality, clarity, and most importantly, strategy.

Pricing That Didn’t Travel

When we entered new markets, we brought the same pricing structure, despite having no brand equity, no client references, and no local validation. It failed to land. Prospects saw a high price and no evidence to justify it. We expected legacy-level pricing power without the credibility to back it up. Now, the US-based team was doing their job selling the product, at least holding their own compared to the competition, while the buyers from international markets had a much different view of either what they expected to pay/or what features should be table stakes.

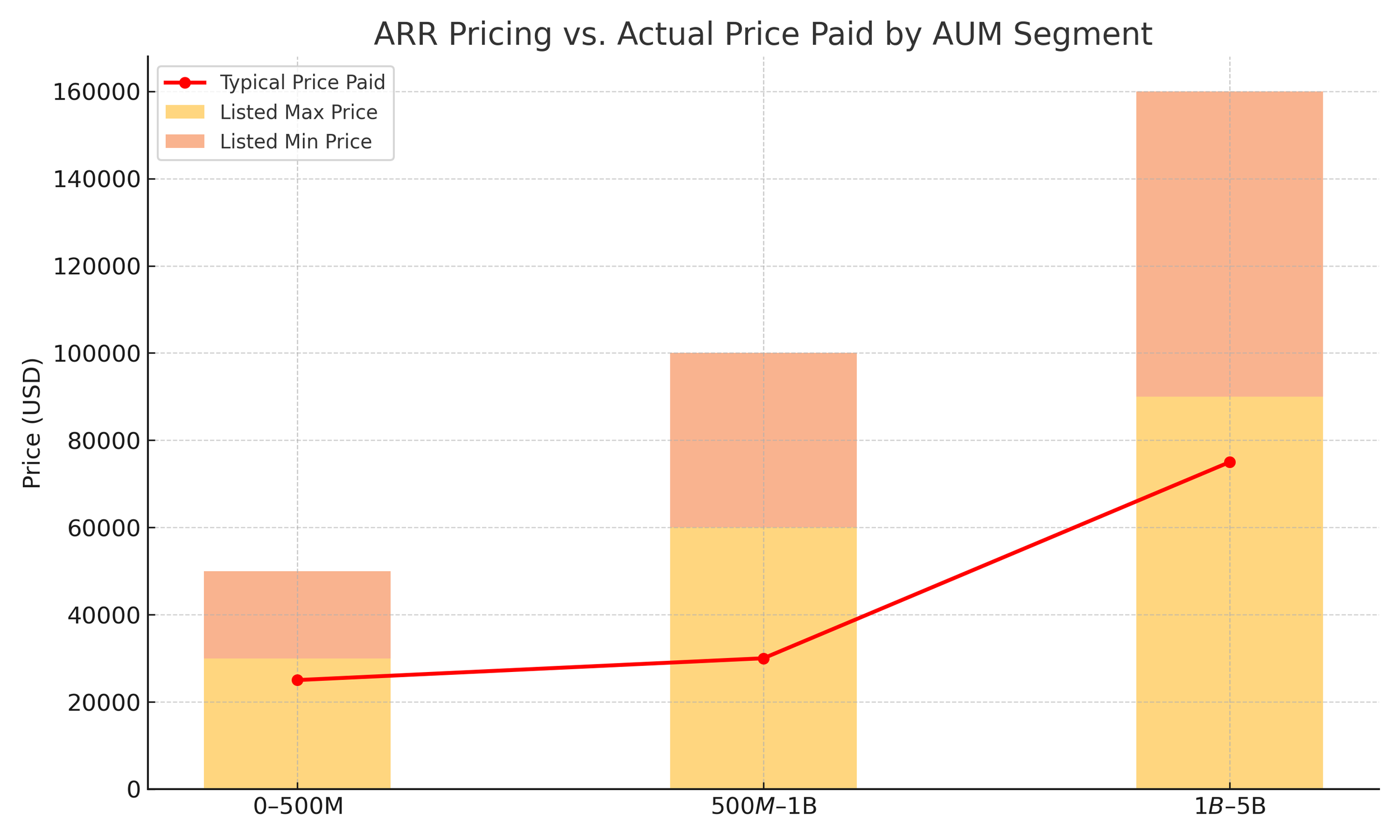

In practice, our mid-sized customers rarely paid what we quoted. Despite fees being set at $40K–$60K, most closed around $30K, right back where smaller clients were priced. That downward pressure became a recurring theme:

Don’t Let Pricing Become Passive

Disruptive companies don’t just build better products. They price like they believe in them and invite the market to believe too. It tells your customers who you are, how you think, and whether you're worth the bet. If your pricing looks like your competitor’s and you’re not the category leader, it’s probably not strategic. It’s safe. And safe doesn’t scale.

Sales leaders should always look at tangible outcomes when thinking about pricing. In our scenario, the flat fee for the entire product made it easy for a buyer to compare us feature for feature to other regional players. Had we (sales & product) collaborated further on outcomes like quarterly investor reports run, and data uploads, the real jobs of the software, it may have been easier for customers to tie the value to immediate wins and lock on to the differentiators. We knew our customers loved our reporting function, and therefore we should have built pricing around that platform, shifting the buyers level view across all vendors.

Especially when entering new markets or launching differentiated features, pricing must evolve. It should adapt to usage, customer maturity, and new data. It should invite experimentation, not fear.

Embracing Change: My Journey from Sales to Pricing

During my time at London Business School, I often heard the advice: "When making a career shift, try to change only one of these—your role, your industry, or your geography—but never all three at once." It’s a smart, pragmatic approach, one that many of my brilliant classmates have followed. And yet, here I am, doing exactly what I was told not to, leaving sales for consulting (or maybe even founding something of my own), moving from niche B2B SaaS into a broader consulting space, and relocating from London back to Colorado.

A major driver of my decision to pursue an Executive MBA in late 2022 was the realization that I wanted to move beyond sales. I was good, but not great and I knew deep down that I lacked the drive to push myself toward that final 1% that separates the best from the rest. My interests had started shifting. Instead of focusing solely on closing deals, I was thinking about bigger, systemic issues—how prospects evaluated our product, where our packaging and pricing fell short, and how we could capture more value.

I’m also a numbers guy. Yes, sales is a metric-driven profession, but it often comes down to a binary outcome: did you hit your number or not? The cycle of living from quota to quota, deal to deal, felt increasingly unfulfilling. Then, in the fall of 2023, my employer decided for me, letting me go and push me to fully commit to a new path.

Why Pricing?

During my 11 years in B2B SaaS, I led international expansion twice and brought a new product to market. I often worked in uncharted waters with no historical data, no established client base, just a small team, a strategy, and a lot of execution. I mapped out the addressable market, created GTM content, built pricing sensitivity models, ran demos, attended conferences, and negotiated deals with some of the top investors in the world.

As I move from sales into consulting, I’m leaning into this experience—the years spent understanding prospects, uncovering pain points, and figuring out what truly drives buying behavior.

So, why pricing? Because it’s a fascinating, often misunderstood lever that can make or break a company. Pricing in B2B SaaS is particularly complex, with the added layer of subscription services creating an ongoing exchange of value between vendor and customer. Businesses don’t buy like individuals, and pricing strategy isn’t just about setting a number, it’s about monetization, incentive structures, packaging, and the mechanics of the exchange itself.

How should a company charge for its product? How do you incentivize a sales team to maximize value capture? How does pricing affect retention, expansion, and overall company health? These are the questions I encountered daily in sales, but never had the bandwidth to fully explore. Now, they’re the questions I want to dedicate my career to answering.

The Road Here

Committing to this new direction wasn’t easy, and it didn’t happen overnight. The past year and a half have been a grind, moving my family across the Atlantic, searching for answers about what’s next, and hitting more than a few dead ends along the way. At one point, I even considered taking one more sales gig, convincing myself it might be the safer choice.

Then came the final interview, a seven-hour marathon that I completely bombed. Halfway through, they dropped me from the process. It was a low point, one that led to a lot of questioning and self-doubt. But in hindsight, it was exactly what I needed.

That moment forced me to be honest with myself: I wasn’t just looking for a new job—I was looking for a new challenge, a new way to apply my skills, and a space where I could make a real impact.

So here I am, taking the path that’s not recommended, making the leap that many would call risky. But I’m doing it with conviction, with a clear sense of why, and with the belief that pricing is where I can make a real difference.